glenwood springs colorado sales tax rate

The Glenwood Springs Sales Tax is collected by the merchant. The sales tax rate does.

Locating And Discovering Sales Tax Medical Icon Sales Tax Medical

The GIS not only shows state sales tax information but it also includes sales tax information for counties municipalities and special taxation districts.

. The County sales tax rate is. The Colorado sales tax rate is currently. To begin please register or login below.

City Hall 101 W 8th Street Glenwood Springs CO 81601 Phone. The combined amount is 820 broken out as follows. 375 City of Glendale 290 State of Colorado10 Cultural Tax25 Arapahoe County 100 RTD Tax 800 Total.

Name Garfield County Treasurers Office Address 109 8th Street Glenwood Springs Colorado. This rate includes any state county city and local sales taxes. MUNIRevs allows you to manage your municipal taxes licensing 24x7.

The Geographic Information System GIS now allows Colorado taxpayers to look up the specific sales tax rate for an individual address. The complete sales tax breakdown is as follows. Lowest sales tax 29 Highest sales tax 112 Colorado Sales Tax.

Average Sales Tax With Local. One of a suite of free online calculators provided by the team at iCalculator. Columbine Valley CO Sales Tax Rate.

The Glenwood Springs sales tax rate is. - Tax Rates can have a big impact when Comparing Cost of Living. The US average is 46.

2020 rates included for use while preparing your income tax deduction. Address Phone Number and Fax Number for Garfield County Treasurers Office a Treasurer Tax Collector Office at 8th Street Glenwood Springs CO. You can find more tax rates and allowances for Glenwood Springs and Colorado in.

The latest sales tax rates for cities starting with A in Colorado CO state. This system allows businesses to access their accounts and submit tax returns and payments online. The 86 sales tax rate in Glenwood Springs consists of 29 Colorado state sales tax 1 Garfield County sales tax 37 Glenwood Springs tax and 1 Special tax.

The County sales tax rate is. Colorado has 560 cities counties and special districts that collect a local sales tax in addition to the Colorado state sales taxClick any locality for a full breakdown of local property taxes or visit our Colorado sales tax calculator to lookup local rates by zip code. On November 3 2015 Colorado Springs voters approved a sales and use tax rate increase of 062 to fund road repair maintenance and improvements.

6 rows The Glenwood Springs Colorado sales tax is 860 consisting of 290 Colorado state. Columbine CO Sales Tax Rate. Colorado has state sales tax of 29 and allows local governments to collect a local option sales tax of up to 8.

Did South Dakota v. Ad Find Out Sales Tax Rates For Free. The minimum combined 2022 sales tax rate for Colorado Springs Colorado is.

Sales Tax Rate Tax applies to subtotal shipping handling for these states only. This is the total of state county and city sales tax rates. Effective with January 2014 sales tax return the penalty interest rate has changed to 05.

The Glenwood Springs Colorado Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Glenwood Springs Colorado in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Glenwood Springs Colorado. Fast Easy Tax Solutions. The Colorado Springs sales tax rate is.

- The Median household income of a Glenwood Springs resident is 54544 a year. Find many great new used options and get the best deals for SILVER SPRUCE MOTOR LODGE MOTEL HOTEL POSTCARD GLENWOOD SPRINGS CO COLORADO 1956 at the best online prices at eBay. Access the MUNIRevs System.

What is the sales tax rate in Glenwood Springs Colorado. If you need access to a database of all Colorado local sales tax rates visit the sales tax data page. Sales and Use Tax Ordinance.

The Colorado Springs sales tax rate is. This is the total of state county and city sales tax rates. Free shipping for many products.

Income and Salaries for Glenwood Springs. Rates include state county and city taxes. Within Glenwood Springs there are around 2 zip codes with the most populous zip code being 81601.

The County sales tax rate is. This includes the sales tax rates on the state county city and special levels. The US average is 28555 a year.

Glenwood Springs CO. Glenwood Springs is located within Garfield County Colorado. Glenwood Springs in Colorado has a tax rate of 86 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Glenwood Springs totaling 57.

This system allows for. Glenwood Springs in Colorado has a tax rate of 86 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Glenwood Springs totaling 57. Sales and Use Tax Ordinance Clarifications Effective 09-07-10 PDF Sales Tax Ordinance Revision Eff.

Did South Dakota v. For questions about sales tax please call 303-639-4706. Colorado Springs CO Sales Tax Rate.

What is the sales tax rate in Colorado Springs Colorado. For tax rates in other cities see Colorado sales taxes by city and county. The Glenwood Springs Colorado sales tax is 860 consisting of 290 Colorado state sales tax and 570 Glenwood Springs local sales taxesThe local sales tax consists of a 100 county sales tax a 370 city sales tax and a 100 special district sales tax used to fund transportation districts local attractions etc.

The average cumulative sales tax rate in Glenwood Springs Colorado is 86. 2021 the City of Colorado Springs sales and use tax rate has decreased from 312 to 307 for all transactions occurring on or after that date. 2020 rates included for use while preparing your income tax deduction.

The City of Glenwood Springs has partnered with MUNIRevs to provide an online business licensing and tax collection system. The minimum combined 2022 sales tax rate for Glenwood Springs Colorado is. - The average income of a Glenwood Springs resident is 28606 a year.

The latest sales tax rate for Glenwood Springs CO. The Colorado sales tax rate is currently. You can print a 86 sales tax table here.

There are a total of 276 local tax jurisdictions across the state collecting an average local tax of 4075. If you need assistance see the FAQ. Did South Dakota v.

Florida Sales Tax Rates By City County 2022

February Sales Tax Reports Show Business Is Booming In Summit County Summitdaily Com

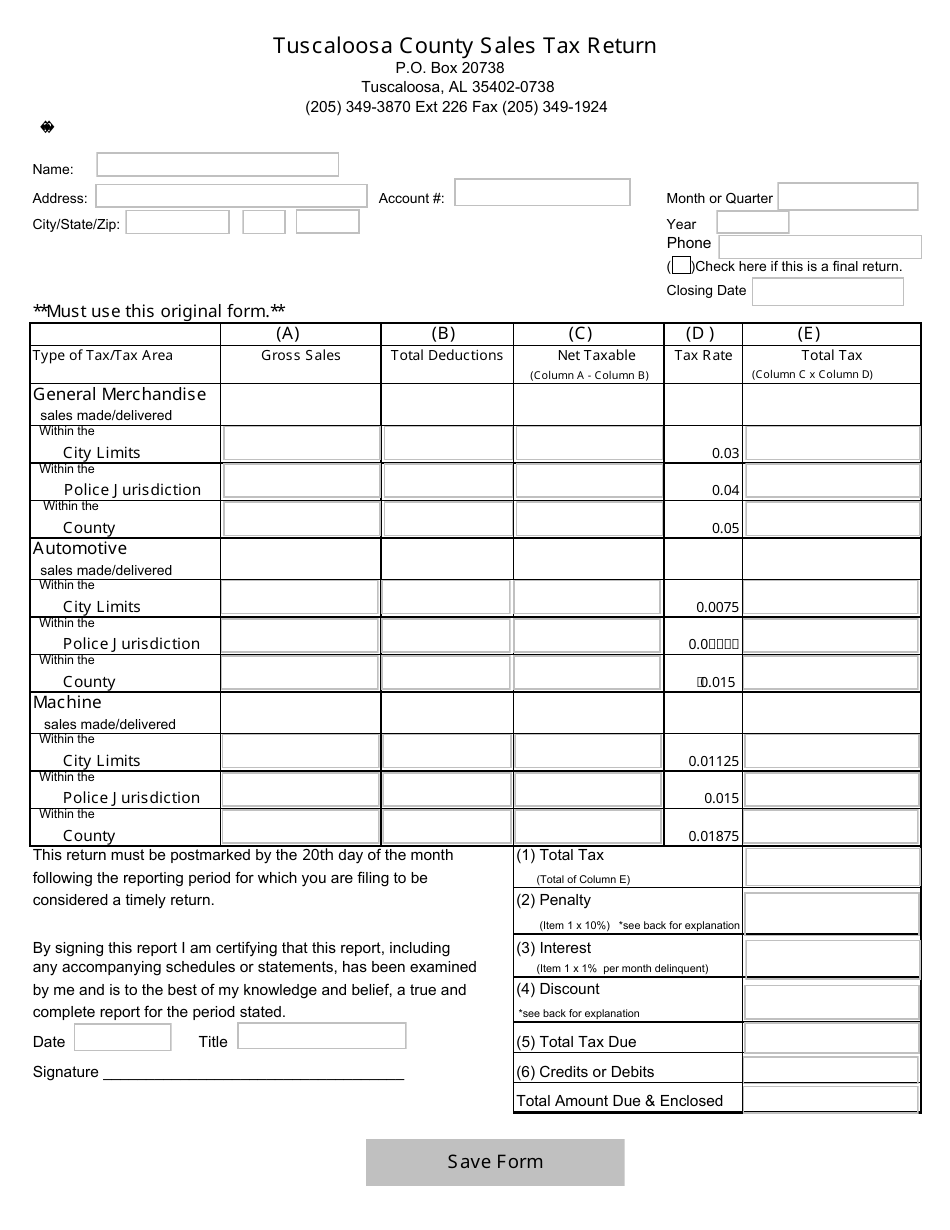

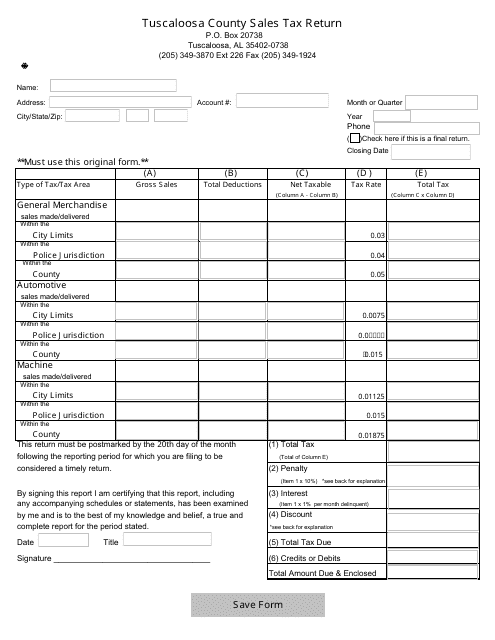

City Of Tuscaloosa Alabama Sales Tax Return Form Download Fillable Pdf Templateroller

Colorado Sales Tax Rates By City County 2022

Colorado Property Tax Calculator Smartasset

Colorado Sales Tax Rates By City

Washington Sales Tax Rates By City County 2022

Missouri Sales Tax Rates By City County 2022

Georgia Sales Tax Rates By City County 2022

March Market Trends Report Denver Area Housing Inventory Breaks Record Low For The Month Of Februar Marketing Trends Denver Real Estate Real Estate Marketing

Arkansas Sales Tax Calculator Reverse Sales Dremployee

Colorado And Denver Marijuana Taxes Rank Near Top And May Grow Axios Denver

Alabama Sales Tax Rates By City County 2022

Where To File Sales Taxes For Colorado Home Rule Jurisdictions Taxjar

New Mexico Sales Tax Rate Changes In May 2022

City Of Tuscaloosa Alabama Sales Tax Return Form Download Fillable Pdf Templateroller

From Principles To Planning Ppt Download

Craig S 2022 Sales Taxes Up Through First Three Months Of The Year Craigdailypress Com